Introduction: BHP proposes takeover of Anglo American

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

There’s takeover excitement in the mining world this morning after Australia’s BHP made a takeover approach for smaller rival Anglo American

The deal, if completed, would be one of the largest in the sector for years, and create the world’s biggest copper miner.

Anglo confirmed overnight that it had received an “unsolicited, non-binding and highly conditional” all-share buyout proposal from BHP Group, which it is currently examining.

The proposal is conditional on Anglo first splitting off its South African platinum and iron ore units, suggesting BHP is primarily interested in Anglo’s copper resources.

Anglo says:

The Board is currently reviewing this proposal with its advisers. There can be no certainty that any offer will be made nor as to the terms on which any such offer might be made.

Pending any further announcements Anglo American shareholders should take no action. A further announcement will be made as and when appropriate.

Mega commodity deal season is back after many years$AAL $BHP

BHP has proposed a takeover of Anglo American in an all-stock deal that would bring together two global mining companies and rank as one of the industry’s largest transactions in years.

BHP, the world’s ....

Anglo had been seen as a potential takeover target since late last year, when it warned that production had been weaker than expected. Shares are down around 10% over the last 12 months.

BHP’s interest in acquiring Anglo raises fresh concerns about an exodus of UK firms from London.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, explains:

‘’The buyout offer from BHP, the world’s largest publicly listed miner, for Anglo American, won’t just shake up the mining industry, but will send a fresh chill through the City of London

There are concerns that if the deal goes through it could be the tip of the iceberg and more giants could leave the exchange. It comes hot on the heels of speculation that Shell might up sticks and leave for New York, rumours that Ocado may be considering leaving for the Big Apple, and follows the crushing disappointment of home-grown chip designer Arm choosing the Nasdaq over the FTSE 100.

The agenda

9am BST: European Central Bank’s economic bulletin

11am BST: CBI’s distributive trades survey of UK retailers

1.30pm BST: US GDP report for Q1 2024

3pm BST: US pending home sales data for March

Key events

The US GDP report also shows that inflationary pressures remained solid in the first quarter of this year.

It shows that the price index for gross domestic purchases increased 3.1% in the first quarter, accelerating from the increase of 1.9% in the fourth quarter.

The personal consumption expenditures (PCE) price index increased 3.4%, compared with an increase of 1.8% in the previous three months.

The core PCE price index, which excludes food and energy prices, increased 3.7%, compared with an increase of 2.0% in Q4 2023.

US economic growth in the last quarter was dragged back by weak global demand.

Today’s GDP report shows that net exports and inventories dragged on growth.

Paul Ashworth, chief North America economist at Capital Economics, explains:

Exports ended up increasing by only 0.9%, illustrating the impact of weak global demand, while imports surged by 7.2%.

Altogether, net exports subtracted nearly 0.9% points from GDP growth, with inventories generating an additional drag of nearly 0.4 percentage points.

⚠️Breaking! 🇺🇸US GDP Slows More Than Expected

📉GDP 1.6% (est. 2.5%, prev. 3.4%)

📉Consumption 2.5% (est. 2.8%, prev. 3.3%)

📉Government Spending 1.2% (prev. 4.6%)

📈Investment 3.2% (prev. 0.7%)

📉Exports 0.9% (prev. 5.1%)

📈Imports 7.2% (prev. 2.2%)

📍More Details:… pic.twitter.com/Zwu6J5FchM

Some snap reaction to the slowdown in US growth in the last quarter:

US GDP growth surprised slowing to 0.4%q/q in the March quarter, to 3% year-ended (from 3.1%). Weakest quarterly growth rate since Q2 2022. pic.twitter.com/mTCEZbRJcV

— James Foster (@JFosterFM) April 25, 2024BREAKING: US Q1 2024 GDP comes in at 1.6%, BELOW expectations of 2.5%.

If 1.6% is the final reading, it will end 6 STRAIGHT quarters of 2%+ growth.

However, we still have not had 2 consecutive quarters with declining GDP since Q2 2022.

Is the economy beginning to weaken?

US growth slows to 1.6% per year

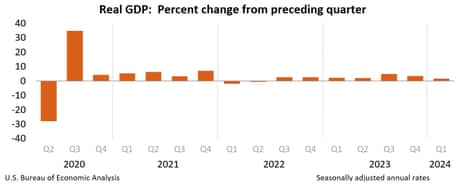

Newsflash: Growth across the US economy has slowed sharply this year, suggesting high interest rates are weighing on the economy.

US GDP grew at an annual rate of 1.6% in the first quarter of 2024, new data shows, meaning it only expanded by 0.4% in the quarter.

That’s a slowdown on the fourth quarter of 2023, when real GDP increased at 3.4% per year (or by 0.85% in the quarter).

It’s also weaker than the 2.4% annualised growth which analysts had expected.

The Bureau of Economic Analysis explains:

Compared to the fourth quarter, the deceleration in real GDP in the first quarter primarily reflected decelerations in consumer spending, exports, and state and local government spending and a downturn in federal government spending.

These movements were partly offset by an acceleration in residential fixed investment. Imports accelerated.

One of Anglo American’s largest shareholders has criticised BHP Group’s takeover proposal.

Legal & General Investment Management warned that the approach by BHP to acquire Anglo for £31.1bn was both “highly opportunistic” and “unattractive”.

Nick Stansbury, head of climate solutions at Legal & General Investment Management (LGIM), told Reuters in an email today:

“As with many other UK-listed companies, we believe the valuation of Anglo American to be depressed and regard the proposed exchange ratio as an unattractive proposition for long-term investors.

The industry is extremely concentrated today, and further consolidating it will not contribute to accelerating investment in the way we believe is needed.”

Legal & General Investment Management are the 11th largest shareholder in Anglo American, according to LSEG data, owning 0.88% of the company.

FT: South African minister hits out at BHP’s £31bn bid for Anglo American

Just in: South Africa’s minerals resources minister has voiced his opposition to BHP’s £31bn proposal to take over Anglo American.

Gwede Mantashe told the Financial Times he was not in favour of the bid because South Africa’s previous experience with BHP was “not positive”.

That’s a reference to BHP’s merger with South Africa’s Billiton in 2001, a deal that was later effectively unwound in 2014 when many of the assets were spun off.

LSEG investors approve plan to hike CEO's pay

Just in: Shareholders in the London Stock Exchange Group have approved the plan to potentially double the pay of CEO David Schwimmer, with only a small rebellion.

At today’s AGM, 88.99% of shares were cast in favour of approving the Directors’ Remuneration Policy, with 11.01% against.

Around 83.5% of shareholders took part, meaning some declined to give a view on whether Schwimmer’s maximum total yearly remuneration should rise to up to £13m (mostly dependent on hitting performance-related targets).

All other resolutions have been approved too.

While some City-listed companies are eying a move overseas, Greek industrial conglomerate Mytilineos is considering a secondary listing in London.

Mytilineos, which operates energy and metallurgy divisions, is currently listed on the Athens stock market.

Today, it revealed it is considering also creating a listing on an international exchange within the next year to 18 months, to offer “enhanced liquidity” to its investors.

Mytilineos has worked with various UK companies and organisations on energy projects, including LightSource BP, Vodafone, Centrica, National Grid and Scottish Power.

Turkey’s central bank has left interest rates on hold today, at an eye-watering 50%.

The Central Bank of the Republic of Türkiye maintained rates today, a month after surprising the market by hiking its key rate from 45% to 50%.

Today, the CBRT explains that the underlying trend of monthly inflation was higher than expected this month, despite continuing to decline.

Turkish interest rates have been raised by 4,150 basis points over the last year, from 8.5%.

UK shoplifting worst in at least 20 years

UK retailers have long been warning that theft from their stores is increasing… and new data from the Office for National Statistics confirms the problem.

The ONS reports that shoplifting offences increased by 37% in 2023, to 430,104 offences, up from 315,040 in 2022.

That the highest figure since current police recording practices began for the year ending March 2003.

Last October, John Lewis chair Sharon White warned that “organised gangs” of shoplifters were targeting high-value items such as bottles of spirits.

The ONS also reports that there were 8.4m incidents of crime last year, similar to 2022.

But there were some annual changes in crime; fraud decreased by 16%, while criminal damage dropped 18%, but there was a 29% increase in computer misuse offences.

The latest from the Crime Survey for England and Wales (CSEW).

For the year ending December 2023 there were an estimated 8.4 million incidents of CSEW headline crime.

Commenting on today’s CSEW figures, the ONS’s Nick Stripe said; (1/2) 💬

The copper price has risen today, highlighting why BHP Group is keen to get its hands on Anglo American’s copper mines.

Copper traded in London is up 0.7% this morning to $9,773 per tonne.

BHP’s interest in Anglo could also be pushing the copper price higher, analysts at Saxo Bank say:

Copper trades near cycle high as the potential of a mega-deal between BHP and Anglo-American highlights the importance and expectations for copper given its key role in the green transition and increased demand via AI roll outs.

Shares in Facebook’s parent company are set to tumble when Wall Street opens in three hours time, after it alarmed traders by outlining plans to “invest aggressively” in artificial intelligence.

Meta beat forecasts with a 27% rise in revenues in the first quarter of the year, while its net profits doubled.

But shares are currently down 13.7% in premarket trading. Investors are concerned that Meta has ramped up its spending plans, with capital expenditures now seen in a $35bn-$40bn range, up from a previous forecast of $30bn-$37bn.

Mark Zuckerberg was unbowed by concerns about his spending on artificial intelligence, saying the priority was “getting millions or billions of people to use Meta AI” rather than generating revenue from it.

Today could be Meta’s worst on the stock market in 18 months, since it reported in October 2022 that profits had halved as advertisers cut spending amid the global economic downturn.

- Meta's premarket losses set the stock up for the biggest intraday decline since October 2022. A 15% drop would wipe about $185 billion from the company’s market value. pic.twitter.com/B0alHTgNXr

— Ahmed Azzam (@3zzamous) April 25, 2024CBI: UK retail sales slide as Easter disrupts spending

Eek. UK retailers have just gone through their worst April for sales since the pandemic lockdown four years ago, new data shows.

The CBI’s distributive trades survey, which tracks whether retailers reported higher or lower sales volumes, has fallen to -44, down from +2 in March.

The decline is probably related to the early timing of Easter this year, the CBI adds.

Here’s the details:

Retail sales volumes fell sharply in the year to April, likely effected by the earlier timing of Easter this year. Retailers expect sales to fall again, at a more moderate pace, next month. #DTS pic.twitter.com/hlETafulTI

— CBI Economics (@CBI_Economics) April 25, 2024Sales were reported to be below “average” for the time of year. Retailers expect sales to continue to remain below seasonal norms next month. #DTS pic.twitter.com/vDr7yWIF2C

— CBI Economics (@CBI_Economics) April 25, 2024Orders placed on suppliers also declined in the year to April, at a quicker pace than last month. Orders are set to fall at a similar rate next month. #DTS pic.twitter.com/Csnt5qU1wm

— CBI Economics (@CBI_Economics) April 25, 2024AstraZeneca boss defends pay deal after results beat forecasts

Julia Kollewe

AstraZeneca’s boss has defended his pay package as necessary to ensure the company can attract a high-calibre successor one day, as he hailed “unprecedented” lung cancer trial results, and cancer treatments propelled sales at Britain’s biggest drugmaker higher.

Pascal Soriot, chief executive of the Anglo-Swedish pharma company, has come under fire for his potential £18.7m maximum pay package, which was recently approved despite a sizeable shareholder rebellion.

He told journalists:

“Of course, I am committed to this company. It really is about making the company competitive and attractive for my successor because I intend to be here for a while still but of course at some point there will be a successor, and our internal candidates but also external candidates will have to be offered a role that is attractive in itself but also compensated competitively.

We are not a UK domestic organisation, we are a UK-based global company. Most of our sales come from outside of this country… And this industry is a global industry and… a lot of the talent is based in the United States… The innovation in our industry is now more and more driven by the United States and China. Europe is unfortunately falling behind.”

The drugmaker beat analysts’ expectations with a 19% rise in total revenues in the first three months of the year to $12.7bn. Oncology drug sales grew by 26% while cardiovascular and metabolic treatments grew by 23%, respiratory drugs by 17% and rare disease treatments by 16%.

Soriot said recent trial results for Tagrisso and Imfinzi, two of its blockbuster cancer drugs, were “unprecedented in lung cancer”. Tagrisso showed “overwhelming efficacy” in a trial for non-small cell lung cancer in February while Imfinzi was the first and only immunotherapy treatment to show survival benefit in small cell lung cancer.

Soriot said that AstraZeneca is moving the weight loss pill it is developing with the Chinese company Eccogene into intermediate clinical trials. It is targeting people who want to lose a limited amount of weight (5-10% of body weight), as well as obese people who will receive a higher dose.

It intends to combine the GLP-1 drug, which aims to reduce appetite, with other drugs the firm is working on to help people lose weight and reduce the risk of heart disease.

Recent research from Morgan Stanley has shown that people using GLP-1 drugs such as Novo Nordisk’s Ozempic and Wegovy and Eli Lilly’s Mounjaro and Zepbound reduce their consumption of tobacco and alcohol – an added health benefit beyond weight loss.

The drugs have proved hugely popular with celebrities and others, despite their high price tag, and have brought in billions of dollars of revenues for Novo and Eli.

1 year ago

1 year ago

(200 x 200 px).png)

English (US) ·

English (US) ·